Businesses in the Black Country need to see Budget measures which build confidence not dampen it, the CEO of the region’s Chamber of Commerce has warned.

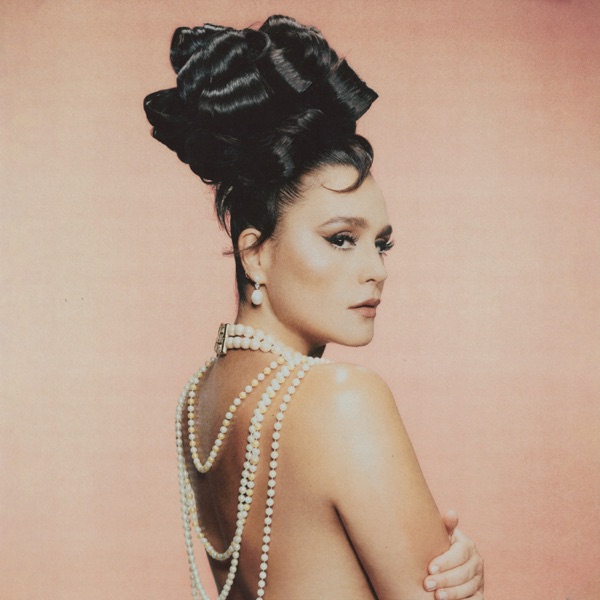

Sarah Moorhouse has called on Chancellor Rachel Reeves to use Wednesday’s Budget to encourage businesses amid widespread speculation around increases in taxation for companies after a survey of members showed concerns about the burden being carried by firms.

Sarah said: “Black Country Chamber of Commerce members are concerned about the tax burden being increased for micro-sized and small and medium sized enterprises, as these are the businesses which need support to grow and expand.

“Over the last 12 months, Black Country businesses have shown higher confidence than national Chamber of Commerce survey results but local companies have adopted a wait and see approach to investing ahead of the Budget, which they fear will see increased taxation impact their companies.

“Businesses are keen to upskill their workforce so the Chamber would like to see help for them to do so by investing in Local Skills Improvement Plans and a well-structured reform of the Growth and Skills Levy.”

A pre-Budget survey of Black Country Chamber of Commerce members showed 58% said they had adopted a “wait and see” approach to investment in the run-up to the first Budget of the Labour Government, while 70% called for a lowering of corporation tax as the measure they wanted to see.

The poll showed 47% wanted the Government to slightly increase public spending while 65% said the investment their business would benefit from most would be grants or subsidies and tax incentives.

With 52% of respondents saying the most pressing skills shortages facing them were management skills, followed by 47% saying industry-specific skills, the measure sought from the government to improve access to training was the reduction or further subsidy of training costs, 58% said.

Half of those who completed a statement on the one thing which the Chancellor could do to enhance business prospects mentioned the reduction of tax or maintaining them at current levels.

The pre-Budget survey results came after the latest quarterly survey by the Black Country Chamber of Commerce, released on October 17, showed 60 per cent of firms predicted turnover would improve over the next year, well above the national Chamber result but down from 71 per cent in Quarter 2.

The data, based on economic surveys completed by local businesses between August 19 and September 12, also showed 50 per cent believed profitability will improve over the next 12 months, compared with 62 per cent three months earlier. Taxation was now the top concern for firms across all sectors in the region, with 31% of businesses citing it as their biggest worry.

Despite the drop in confidence, the Black Country survey showed companies are more positive than in Quarter 3 of last year, when 55 per cent believed turnover would improve over the next 12 months and 45 per cent believed profitability would improve over the next 12 months.

Sarah added: “Black Country business confidence levels have been tracked by the Quarterly Economic Survey throughout 2024 as being above national levels recorded in the quarterly British Chambers of Commerce survey and remain higher than the results of the most recent UK-wide poll.

“We need to see measures will build upon this confidence to enable the Black Country to flourish and look forward to seeing the detail of the Chancellor’s Budget to gauge the support which we hope can build success.”

Comments

Add a comment